Outperform competitor pricing strategies with AI Portfolio analysis

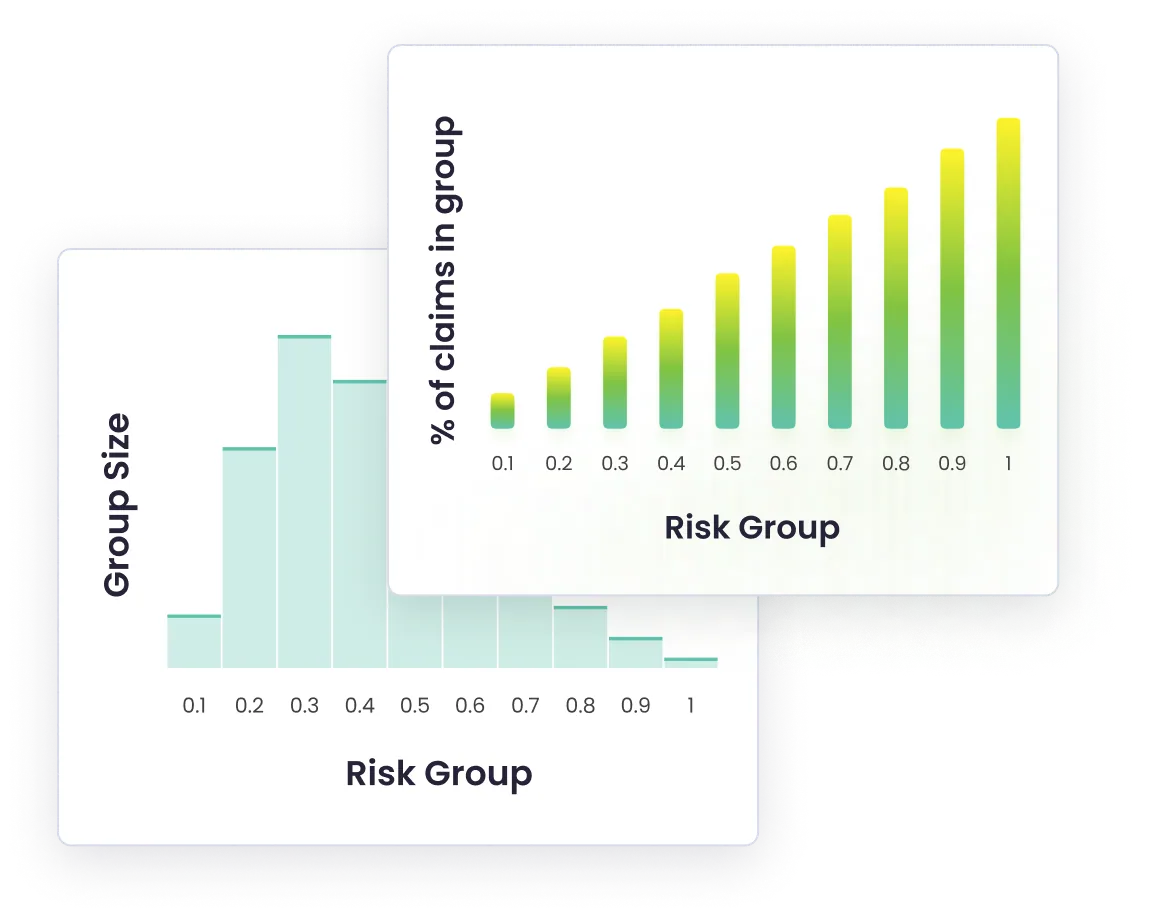

Experience a significant reduction of up to 6% in loss ratio and a remarkable 9% decrease in claim frequency by harnessing the power of K2G AI modeling

K2G collaborates with pricing teams to achieve a risk-adjusted pricing for each policy using AI

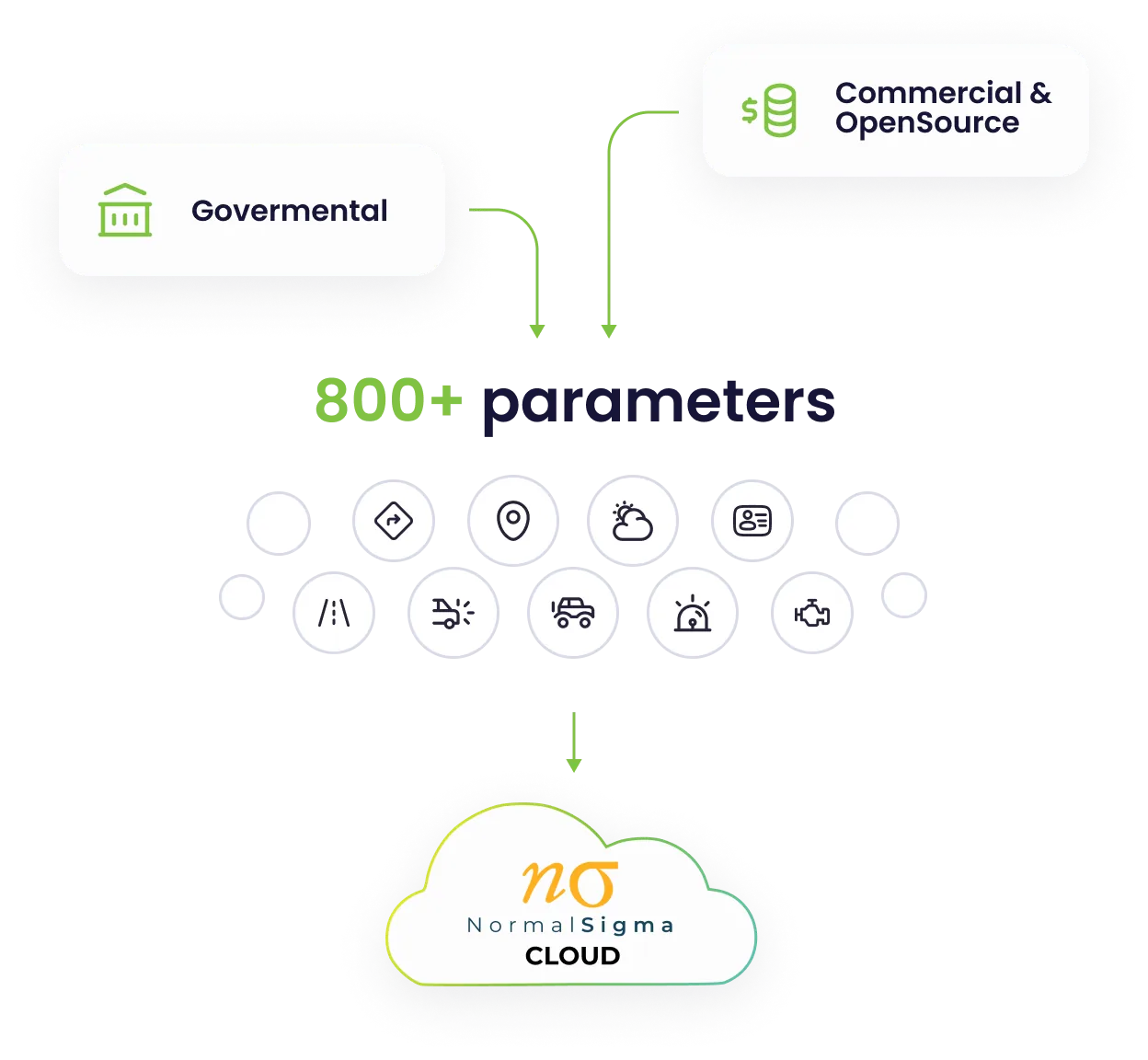

To support the insurer's strategy, K2G enriches and cleanses anonymized policy data provided by the insurer, in order to build effective ISO 27001 complaint AI models. Here is how it works:

Define your strategy

Increase profitability or market share — can you achieve both?

Transform data

into insights

Our platform enriches and cleanses anonymized policy and claims data, fully compliant with ISO 27001 standards. We leverage this data to build powerful AI models that uncover actionable insights for your pricing decisions and next strategic steps.

Double-test

Once developed, our AI models undergo rigorous testing and validation processes. Your pricing team verifies the model's performance using historical data, ensuring its accuracy and effectiveness before implementation.

Unlocking advantages

Enhanced predictive capabilities

Our AI models uncover hidden patterns within vast datasets, empowering teams to make highly precise predictions.

Optimized risk pricing

Fine-tune risk pricing strategies with unparalleled accuracy and profitability.

Tailored pricing solutions

Customized and adaptable pricing that reflects the customer's risk profile and preferences, aligned with the insurer's business and financial goals.

Improved customer satisfaction

Reduce instances of anti-selection, enhancing customer satisfaction and fostering loyalty.

Dynamic pricing customization

Precisely tailor prices to match the unique needs and characteristics of each customer, improving engagement and conversion.

Agile response to market dynamics

Stay agile in response to market dynamics, including shifts in demand and competitive trends.

Flexible and efficient marketing

Implement versatile marketing strategies that efficiently reach your target audience and maximize impact.

Identifying advertising opportunities

Discover untapped opportunities for advertising campaigns, expanding your reach and driving growth.

Analyzing advertising effectiveness

Gain insights into the effectiveness of your advertising efforts, optimizing ROI and maximizing returns on marketing investments.

The figures from K2G convinced us in the proof of concept and we therefore decided to use AI technology in our pricing to be able to make the best offer to the best customers

Dr. Michael Amman

Chief Underwriting Officer

Let's talk!

Discover our approach for building advanced, high-performance models.

- Follow our LinkedIn page

- Follow our CEO

Frequently asked questions

Everything you need to know about the product and billing.

Connect with us in your language

Locate your representative for seamless communication and support.

Arina Man

CEO

Arina Man

CEO

Arina Man

CEO

Arina Man

CEO

Olena Horshkova

Senior Expert Actuary and Underwriter

Arina Man

CEO