Cleansing Agent

Intelligent Data Cleaning Agent

Turn messy, inconsistent datasets into a reliable foundation for analytics and business decisions

Accelerated operations

Routine processes are reduced from months to hours — or from weeks to minutes.

Faster error detection

Mistakes that used to take months to find are now revealed in minutes.

Accurate and standardized datasets

A reliable foundation for analytics, reporting, and model building.

Try for 30 Days FreeSee how K2G Cleansing can transform your datasets in just a few hours.

Book a demo

Discover what sets this apart as the market's easiest and most powerful video interviewing

platform, and why hiring managers consistently choose us over the competition

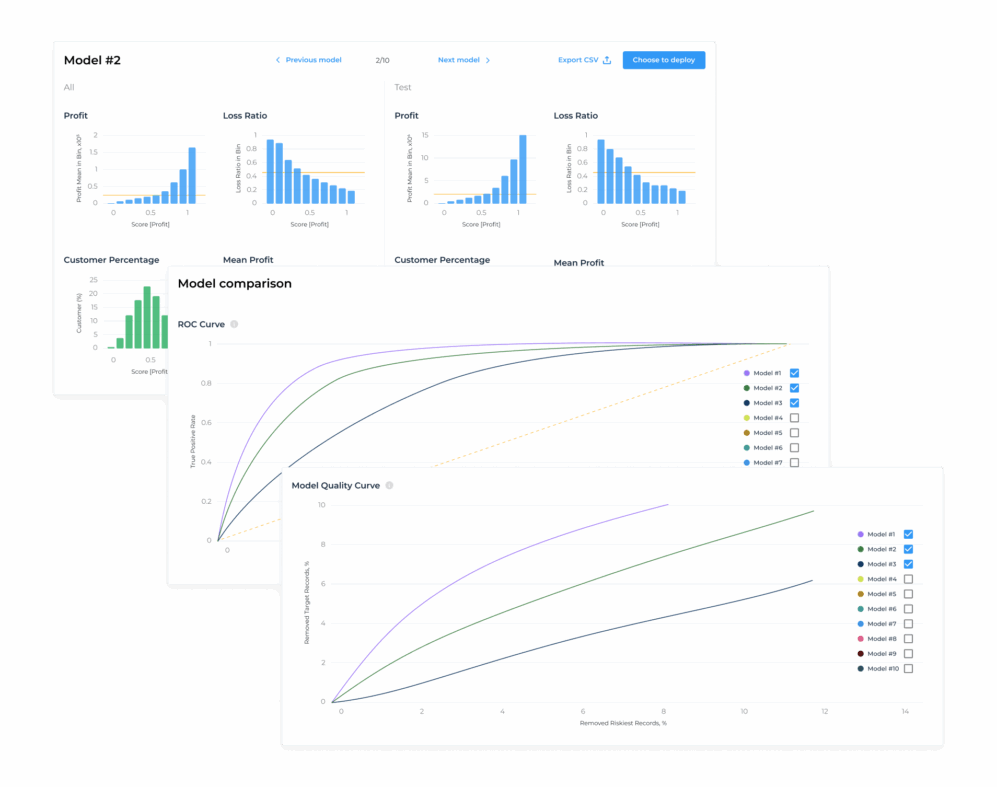

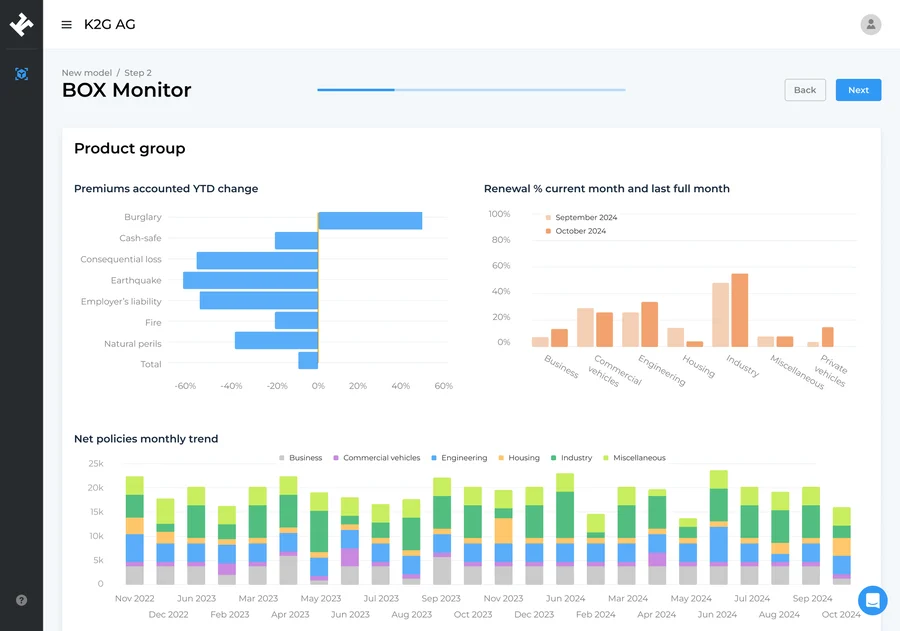

Reduce losses through precise data classification and risk evaluation. Clean, standardized datasets ensure consistent pricing and more reliable underwriting decisions.

Identify hidden fraud patterns automatically — for example, multiple claims paid to the same account or repeated records under different IDs. Gain control and transparency over suspicious data.

Stay compliant with evolving data governance and reporting requirements. K2G Cleansing minimizes manual errors and ensures traceability for audits and regulators.

Prepare your data for new pricing models, dashboards, and business intelligence tools. Enable your teams to focus on insights instead of cleanup.