BOX Solution

End-to-end AI platform for building, enriching, and deploying insurance risk models

Upload your policy data, enrich it with external parameters, and generate stable, production-ready pricing and risk assessment models in hours — not months.

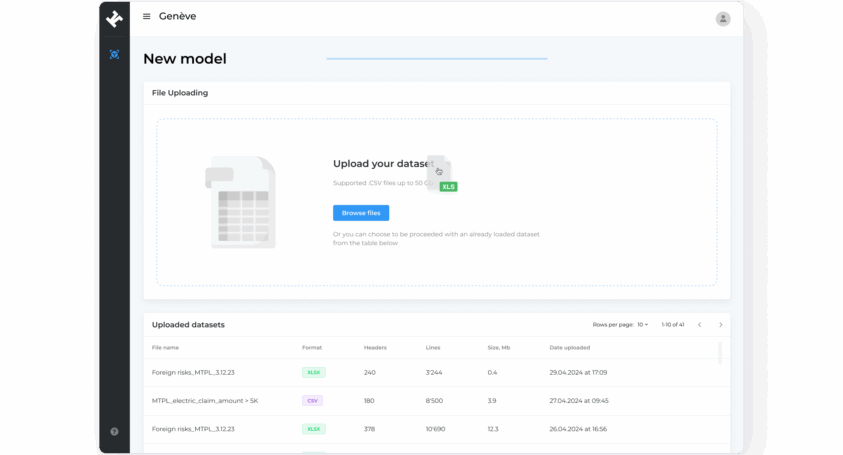

Upload CSV or XLSX files or connect your internal database. K2G BOX automatically validates and cleanses your dataset using built-in rules or your custom logic.

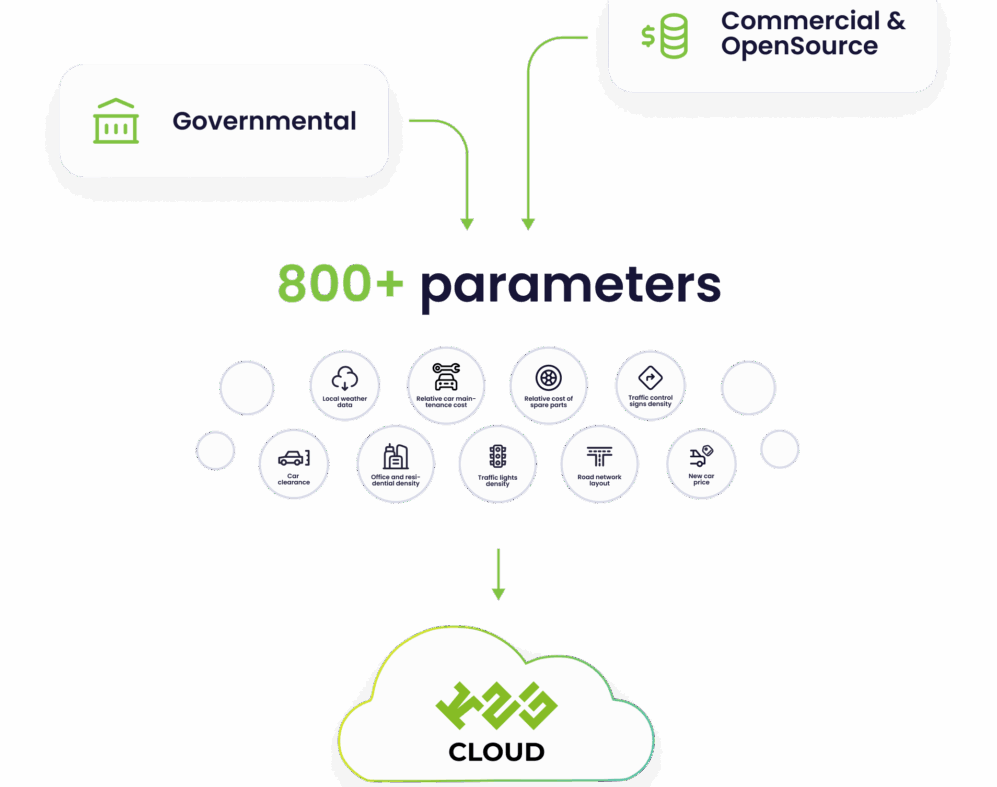

Enhance your dataset with parameters from the K2G Data Lake — including weather, geolocation, infrastructure, and other region-specific external factors — to strengthen your risk models.

K2G BOX generates the top 10 model candidates, shows ROC curves, ranking curves, and stability metrics, and lets you instantly deploy the selected model via API or use it for renewal assessments.

Faster modelling cycles

From months to hours — pricing teams deliver results on time.

Explainable and compliant models

Clear metrics, curves, and validation insights support regulatory requirements.

Scalable and stable performance

Works with millions of records and high-load production systems.

Try K2G BOX Solution for free or request a live demo.

Book a demoBOX enables insurers to release and update pricing models every month — instead of once a year.

AI-powered recommendations highlight mispriced segments and validate expert intuition.

More accurate segmentation and risk calculations reduce portfolio losses.

Correct pricing helps identify profitable niche segments — e.g., discovering a low-risk subgroup like couriers among low-power vehicle owners.