Modelling Agent

Intelligent Risk Modelling Agent

Build accurate, explainable, and production-ready pricing and risk models powered by statistical methods and neural networks.

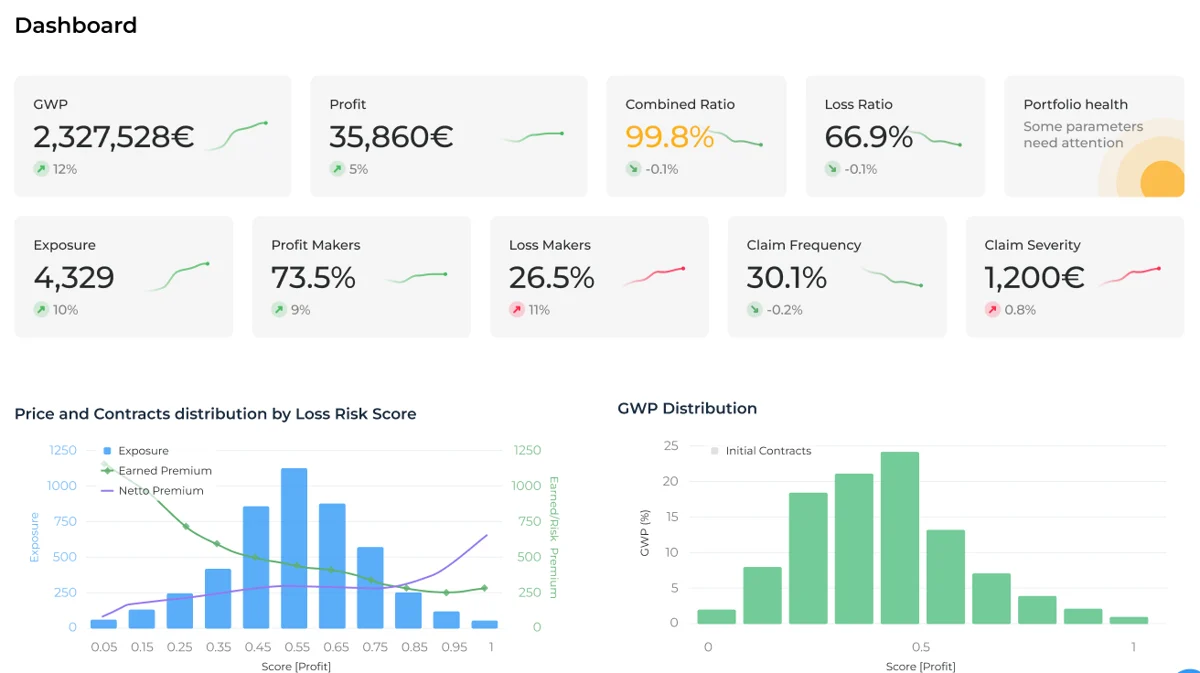

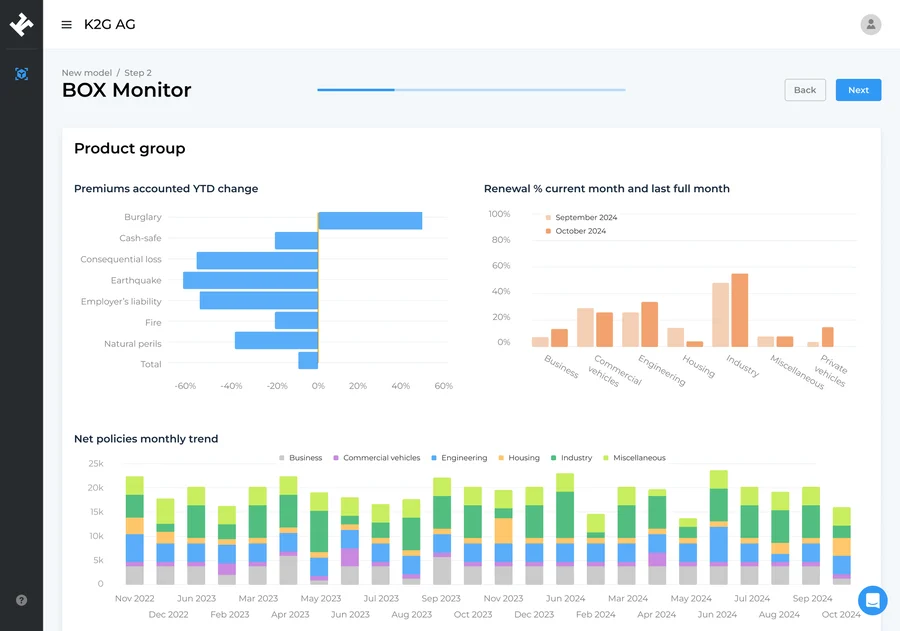

Automatically trains multiple approaches to evaluate risks and uncover hidden patterns.

Generates full performance reports, lifts, stability metrics, and monitoring results.

Creates visual dashboards and instantly launches APIs for underwriting and pricing teams.

Shorter modelling cycles

Models that previously took months to build can be created in days.

Explainable results

Full transparency of drivers, metrics, and model behavior.

Scalable for millions of records

Handles high-volume datasets and heavy production loads.

See how K2G Modelling speeds up your pricing and risk model development.

Book a demoRelease new pricing models every month instead of once a year. Stay ahead of competitors with continuously improved tariffs.

AI-powered recommendations validate existing approaches and highlight potential mispricing.

More accurate risk estimations improve segmentation and decrease loss ratio.

Correct pricing uncovers profitable customer segments — e.g., identifying low-risk couriers among low-power vehicle owners.