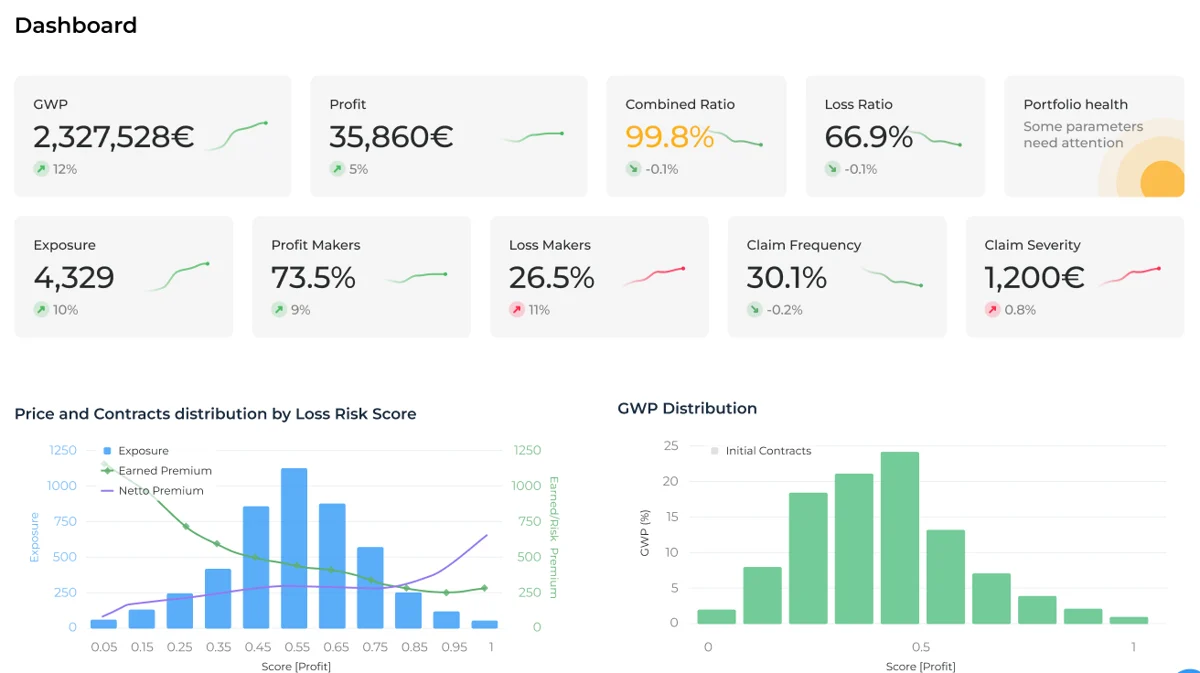

Entwickelt für alle Schlüsselpositionen in Versicherungsunternehmen – von Führungskräften bis hin zu Underwritern K2G BOX® löst spezifische Herausforderungen und erzielt messbare Ergebnisse.

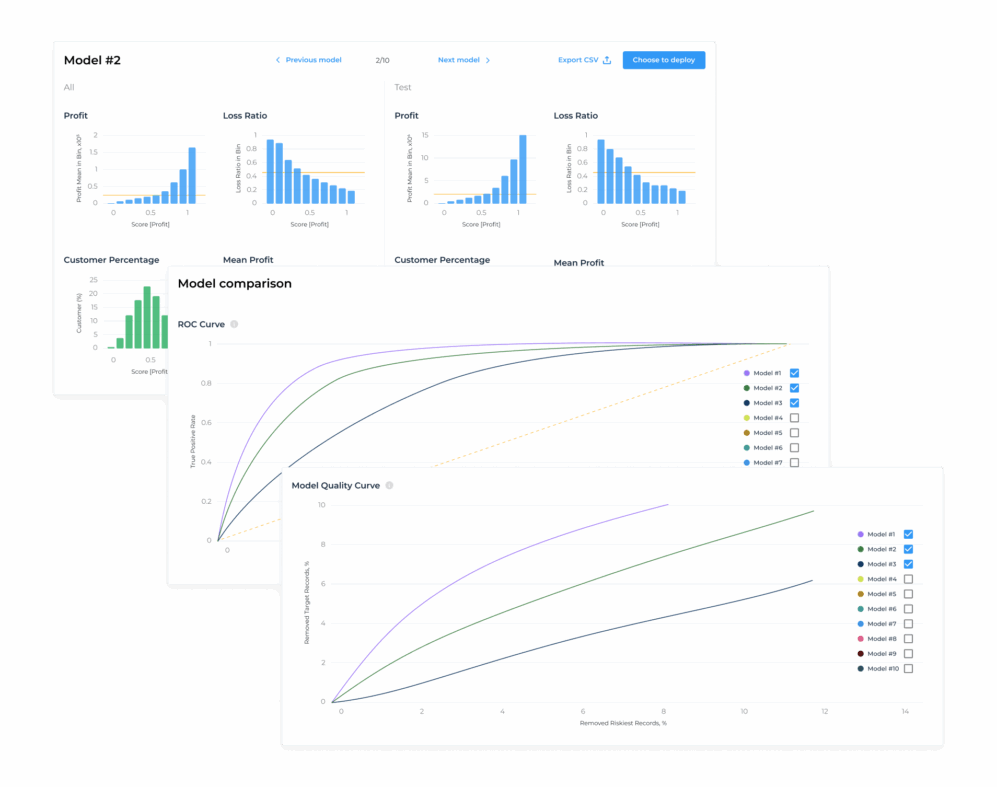

Laden Sie Ihre vorhandenen Datensätze ganz einfach im CSV- oder XLSX-Format hoch. K2G BOX® unterstützt die nahtlose Integration in Ihre aktuelle Dateninfrastruktur.

Verwenden Sie vorinstallierte Validierungsregeln, die auf über 30 Millionen Richtlinien basieren, um Ihren Datensatz zu bereinigen und vorzubereiten. Erstellen Sie benutzerdefinierte Regeln, um die spezifischen Anforderungen Ihres Unternehmens zu erfüllen.

Wählen Sie aus Hunderten von Parametern, die von K2G und vertrauenswürdigen Drittanbietern bereitgestellt werden. Diese Daten decken mehrere Regionen und Kategorien ab und bereichern Ihre Modelle für tiefere Einblicke.

Entwickelt für Versicherer, die bei jeder Entscheidung auf Schnelligkeit, Genauigkeit und Effizienz setzen.